A new NBER working paper (Did the Modern Mortgage Set the Stage for the U.S. Baby Boom? by Lisa J. Dettling & Melissa Schettini Kearney) reveals an unexpected (well, actually expected) catalyst behind America’s famous baby boom: government-backed mortgages that transformed homeownership and family formation patterns.

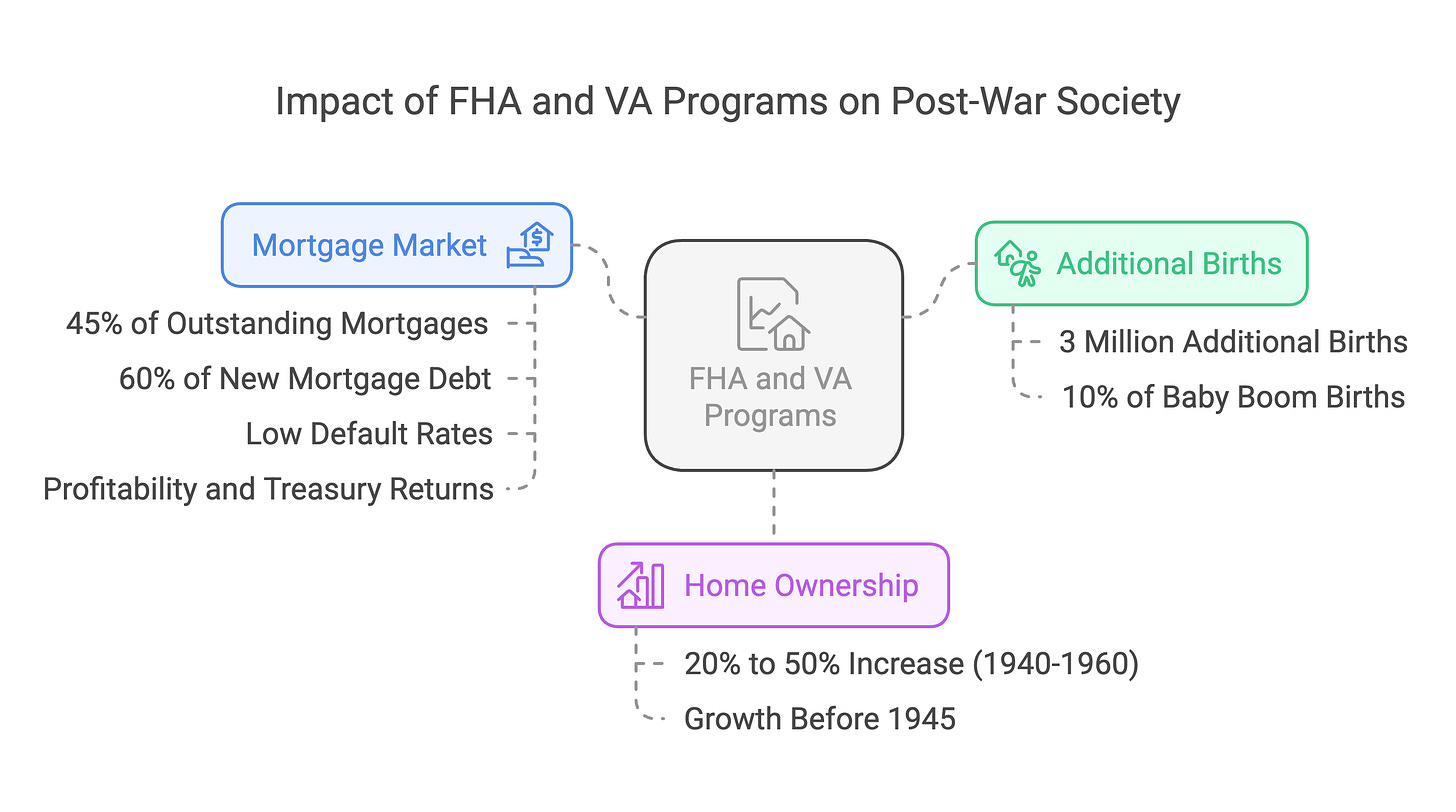

Why it matters: The FHA and VA mortgage programs impacted more than homeownership – they helped reshape American families at a time when orthodox economic theory suggested birth rates should have been falling, not booming.

Data and Insights

- Birth rates rose 50% between 1935-1960

- Young adult homeownership jumped from 20% to 50% (1940-1960)

- FHA/VA loans led to approximately 3 million additional births

- Every 1,000 mortgages resulted in about 309 more births

- These loans accounted for ~10% of “excess” baby boom births

- By the early 1950s, FHA/VA loans represented:

- 45% of all outstanding mortgages

- 60% of new mortgage debt

The timing puzzle: Traditional explanations hit a snag when examining when the boom began. Birth rates started climbing in the mid-1930s when:

- Unemployment hovered around 20%

- The Great Depression’s shadow still loomed

- World War II hadn’t begun

- Every economic indicator suggests families should have fewer children

Big Picture

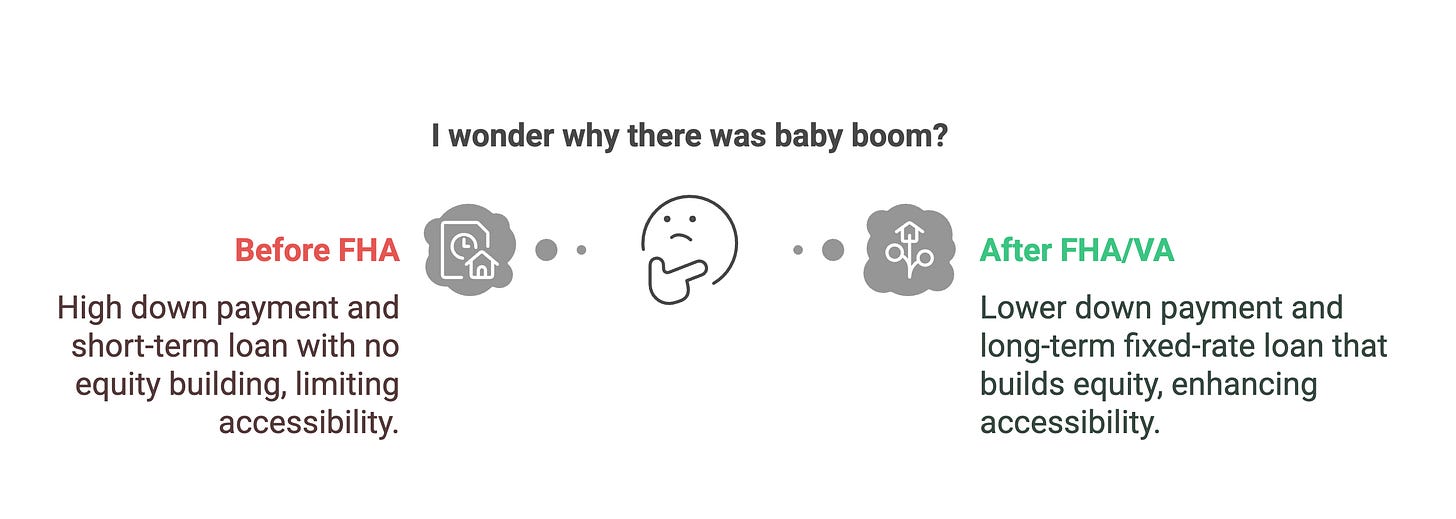

The timing aligns perfectly with the 1934 creation of the FHA mortgage program, which revolutionized home buying:

Before FHA (typical $100k home):

- $45,000 down payment

- $250 monthly interest-only payments

- Full $55,000 balance due in 5-11 years

- No equity building except appreciation

- Few working/middle-class families qualified

After FHA/VA:

- $20,000 down (FHA) or $0 (VA)

- $500 monthly payments

- 20-30 year terms

- Fixed rates

- Full amortization

- Builds equity over time

- Accessible to middle/working class

Between the lines: The birth rate growth sustained despite factors typically associated with falling fertility:

- Rising educational attainment

- Increasing female labor force participation

- Half of the homeownership growth occurred before 1945

- Default rates remained low

- FHA was consistently profitable and returned money to the Treasury

- Programs led private lenders to adopt similar terms

The dark side: The programs systematically excluded Black Americans through discriminatory “redlining” practices that continue to impact communities today:

- FHA and VA explicitly refused to insure mortgages in or near Black neighborhoods

- This made homeownership – and its wealth-building benefits – effectively impossible for Black families

- The study confirms these racial inequities: there was no increase in nonwhite birth rates, reflecting Black Americans’ forced exclusion from these programs

- Historians note this federal policy helped cement racial segregation in American housing that persists decades later!

Bottomline

While the baby boom was an international phenomenon, America’s experience was notably larger. Research suggests the unique government intervention in mortgage markets could explain this. Countries that adopted lower down payment mortgages by the 1960s experienced a larger baby boom.

What’s next: With current fertility rates below replacement level in most advanced economies and young adult homeownership down sharply since the Great Recession, the findings suggest making homes more attainable could impact birth rates more than traditional policy tools like tax incentives and childcare subsidies, which have shown only modest effects.

Leave a Reply