Donald Trump’s campaign promises would send the national debt soaring much faster than Kamala Harris’ would, per two new analyses from the Penn Wharton Budget Model. Both of them increase the deficit relative to the current baseline.

Why it matters: When the government gives money to individuals and businesses, as both candidates propose, that’s good for the recipients, and broadly good for economic growth, but it also accelerates the growth of the national debt, which is already at worrisome levels.

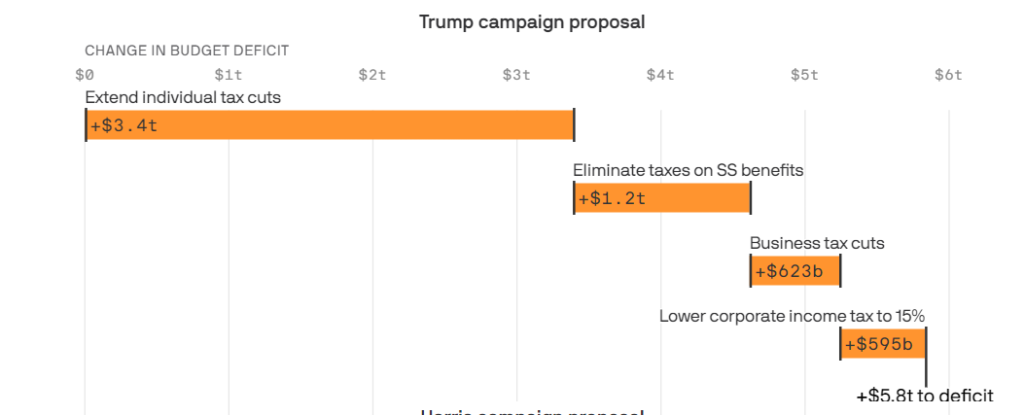

What they found: Keeping Trump’s campaign promises would increase the national debt by $5.8 trillion over 10 years, while Harris’ would cost $1.2 trillion.

- If the policies are scored using “dynamic pricing” that reflects increased tax revenues from policies that increase economic activity, the gap shrinks a little, with Trump’s promises costing $4.1 trillion to Harris’ $2 trillion.

Between the lines: The biggest difference between the two candidates is the question of what happens to Trump’s tax cuts, which are due to expire at the end of 2025. Trump would extend them but Harris wouldn’t.

- Extending the individual income tax cuts would cost $3.4 trillion over 10 years. Doing the same for the corporate income tax cuts would bring the total to over $4 trillion.

- On top of that, Trump wants to cut the corporate income tax even further, to 15% from its current 21%, at an estimated cost of $600 billion, and abolish the income tax on Social Security benefits, which would cost another $1.2 trillion.

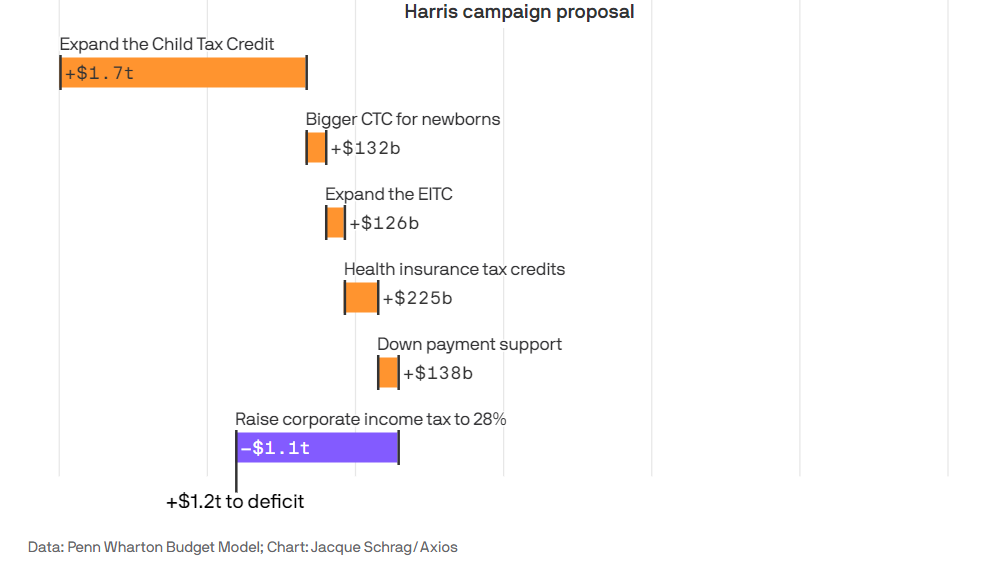

The other side: Harris, by contrast, wants to increase the corporate income tax to 28%, which would raise $1.1 trillion for the public fisc.

- That’s more than enough to pay for the cost of increasing the child tax credit to $6,000 for newborns; for expanding the earned income tax credit; for extending the tax credit that currently exists for health insurance premiums; and for providing down payment support for first-time homebuyers. Between them, those policies would cost about $600 billion.

- Harris has one other very large proposed expense, however, which is raising the child tax credit to $3,000 for children over five years old and $3,600 for children aged five years and younger. (It currently stands at $2,000, and is set to drop to $1,000 in 2026.)

- That policy would cost $1.7 trillion over a decade.

By the numbers: The Wharton study concludes that the Trump proposals would increase the national debt by 9.3% above its current trajectory by 2034, and by 12.7% by 2054.

- The equivalent numbers for the Harris proposals are 4.4% and 7.7% respectively.

- Trump’s proposals would see U.S. GDP fall by a relatively modest 0.4% relative to the current baseline by 2034. The Harris proposals mean a slightly larger decrease of 1.3%.

Follow the money: The top 1% would see their post-tax income rise by $47,000 in 2026 under Trump, compared to a fall of $9,000 under Harris.

- The median household would see an income gain of about $2,000 per year under both plans.

The bottom line: If the GOP was ever a party committed to reducing the national debt, it’s not anymore.

Last modified: September 17, 2024